do nonprofits pay taxes on donations

As of 2014 that amount was 14000. Donations that others make to nonprofits are generally tax-deductible for those individuals but the nonprofit wont pay taxes on those donations.

Non Profit Donation Letter For Taxes Google Search Fundraising Letter Charity Fundraising Nonprofit Fundraising

Tips for Taxpayers Making Charitable Donations Tips to ensure that contributions pay off on your tax return.

. An agricultural organization a board of trade or a chamber of commerce as described in paragraph 149 1 e of the Act. Taxes Nonprofits DO Pay. Special Charitable Contributions for Certain IRA Owners Tax tips for donating IRA funds to charitable organizations.

This may be through offering goods to the community or providing services that are needed by the local population. The recipient need not pay tax on the money but the giver needs to report contributions in excess of 15000. To be tax exempt most organizations must apply for recognition of.

Sometimes find out What Taxes Do Nonprofits Pay. There are 27 different types of nonprofits in the federal tax code and some arent actually exempt from taxes. Youre permitted to raise a reasonable amount of funds from unrelated activities but that income.

The details of what taxes nonprofits pay lie in Unrelated Business Taxable Income UBTI. Recipients do not report them on their taxes. It depends on whether the IRS classes donations as a gift or income.

As a flesh-and-blood human being you cant be a charity even if youre a charity case. Although many nonprofit and religious organizations are exempt from federal and state income tax there is no similar broad exemption from California sales and use tax. Among them are churches church-controlled organizations assemblies special associations and.

Any fees charged by the crowdfunding company are legitimate fundraising expenses that you can deduct if you need to pay tax on income you received as payment for raising the funds. Again discounted pricing will not apply to your account until you have received. People cant make tax-exempt donations to you the way they can to the Red Cross or a church but that doesnt mean you have to pay tax on money youre given.

Tax considerations surrounding accepting crypto donations Nonprofit organizations are increasingly accepting Bitcoin and other cryptocurrency donations because of the favorable taxes and fees. Do i need to pay tax on donations that were given to me. The purpose of a nonprofit is to serve the public.

Most nonprofit organizations must pay sales tax on items and taxable services they purchase for their own use including items that will be given away to others. Nonprofits are also recognized in the Internal Revenue Code IRC as tax-exempt which means they do not pay federal income taxes on charitable contributions. Gifts or money you received as a present isnt taxable but you do owe taxes on any income it produces.

The IRS categorizes crypto as property which means taxes on crypto donations are treated the same as donations of stocks with lower tax rates than US. All income generated from activities substantially related to that purpose are tax exempt. Most nonprofits have paid staff.

Donations to pay someones medical or educational expenses are not. Do I Pay Taxes On Plasma Donations Max Out Your 401 By Dec 31. In general a person can give any individual a certain amount each year without triggering gift tax.

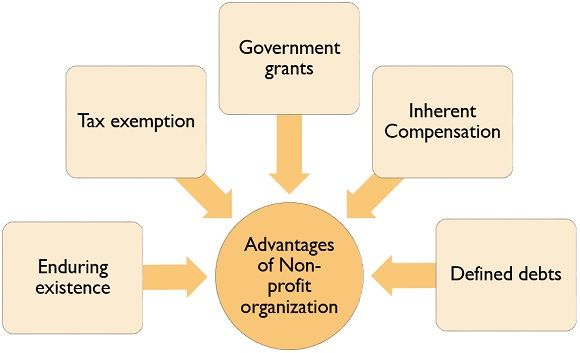

Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions. Contributions to a traditional 401 reduce your total taxable income for the year. There are more than 25 types of organizations that are classified in the IRC as tax-exempt.

However this corporate status does not automatically grant exemption from federal income tax. They must pay payroll tax all sales and use tax and unrelated business income. While there is no general sales tax exclusion for nonprofit organizations certain types of organizations are eligible for specific tax exemptions and exclusions.

View solution in original post. Gift taxes are the responsibility of the person giving the gift. The research to determine whether or not sales tax is due lies with the nonprofit.

You pay use tax when the seller does not collect sales tax at the time of sale for example items purchased over the Internet and by mail order Use tax is paid on the Excise Tax Return or. The Virginia Beach Strong Act Tax deductible contributions to survivors of Virginia Beach Shooting. Some have thousands of employees while others employ a couple of key people and rely on.

The Donate Button Express Checkout and PayPal Payments Pro products. Nonprofits are also exempt from paying sales tax and property tax. Nonprofit organizations must pay income tax on certain income.

A nonprofits tax requirements are complicated often dictated by their activities business purpose their state or citys requirements and more. You May Like. While the income of a nonprofit organization may not be subject to federal taxes nonprofit organizations do pay employee taxes.

The IRS will look at the payment made to a nonprofit by a corporate sponsor and decide whether the payment is a tax-free gift charitable contribution or a taxable advertising paymentThe IRS focuses on whether the corporate sponsor has any expectation that it will receive a substantial return benefit for its payment. Nonprofit organizations must pay sales tax to the seller at the time of purchase. For example lets say you make 65000 a year and put 19500 into your 401.

If so the payment will result in taxable income for the nonprofit. Nonprofit organizations with very limited exceptions must collect sales tax on items they sell. The IRS which regulates tax-exempt status allows a 501 c 3 nonprofit to pay reasonable salaries to officers employees or agents for services rendered to further the nonprofit corporations tax-exempt purposes.

A non-profit organization NPO as described in paragraph 149 1 l of the Income Tax Act. Employees collecting a payroll check from a nonprofit or church are just as liable as the rest of us making a living. Your organization has a tax-exempt purpose.

Even though the federal government awards federal tax-exempt status a state can require additional documentation to. If you have 100000 or less in monthly volume you pay 22 30 per domestic transaction If you have more than 100000 in monthly volume please call 866-365-6319. If your organization is one that seeks to serve others rather than yourself than you may indeed be a non-profit organization.

For example if you receive bonds as a gift you must report any interest the bonds earned after you received them. Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction. Federal Tax Obligations of Non-Profit Corporations.

Nonprofits and churches arent completely off of Uncle Sams hook. This guide is for you if you represent an organization that is. There are number of different types of non-profit organizations out there and consequently there are a number of different ways you can secure the status of being an organization whose donations are tax-deductible.

What Does a Nonprofit Do.

Free Charity Banners For Non Profit Organizations Charity Non Profit Nonprofit Organization

Difference Between Think Tank Charity Business Administration

Donation Form Template Sponsorship Levels Donation Letter Donation Form

Fundraising Nonprofit Raisingfundstips Sponsorship Proposal Charitable Contributions Nonprofit Fundraising

What Is The Difference Between Nonprofit And Tax Exempt Nonprofit Startup Start A Non Profit Non Profit

How To Start A Non Profit Organization In Pennsylvania Paperwork Cost And Time Http Localhost Inform Start A Non Profit Non Profit Nonprofit Organization

How Current Us Tax Policy Impacts Donors And Nonprofits

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

New Annual Budget Templates Xlstemplate Xlssample Xls Xlsdata Check More At Https Whitemelon Co Annual Budge Budget Template Budget Spreadsheet Budgeting

Fundraising Infographic Fundraising Infographic A Brief History Of Charitable Giving Visual Ly Charitable Giving Infographic Charitable

How To Start A Nonprofit In 4 Parts Nonprofit Startup Start A Non Profit Nonprofit Management

Nonprofit Donation Processing The Ultimate Guide Updated 2022

Fiscal Sponsorship For Nonprofits Sponsorship Levels Nonprofit Startup Grant Writing

How To Write A Corporate Sponsorship Proposal On Get Corporate Sponsorship Curated By Anisha Robi Sponsorship Proposal Sponsorship Letter Nonprofit Fundraising

Pin On Diane S Videos And Blog Posts

Complete Guide To Donation Receipts For Nonprofits